At the end of our last juicy musing, we established energy's role as the ultimate backstop for Bitcoin. To repeat, the network offers a 'simple conversion of energy (via math and code) into verifiable truth'. Whilst that feels like a perfectly reasonable tradeoff, the resulting demand for real-world resource can leave Bitcoin open to criticism. Isn't this a rather one-sided, wasteful affair? Environmental activists lead with an appealing narrative; no innocent polar bear (or low lying tropical island) should ever be sacrificed for the sake of magic internet money.

Fortunately, we have an oh-so-sweet counterargument. Bitcoin is the missing piece of the 'net zero' puzzle. The network improves the viability of renewable power generation. The technology feels right at home with corporate ESG (Environmental, Social and Governance) goals. To unpack this all, I've mashed together a few sources; a wonderful interview with James McGinniss (Mining as a Load Resource), his recent article on a proposed Electrodollar and two fascinating podcast appearances with Shaun Connell (Bitcoin Energy Markets and The Bitcoin Energy Revolution). On that note, let's get cracking!

Rock Down to Electric Avenue

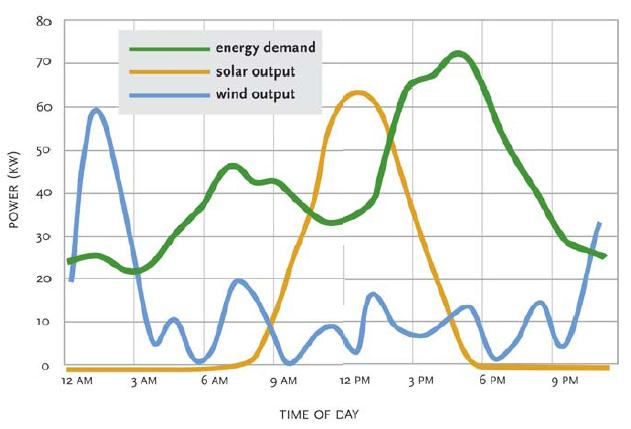

Recall that miners are the bridge between Bitcoin and energy use. They connect specialist computers (ASICS) to an electrical supply and perform proof-of-work (PoW) calculations, the final ingredient for Bitcoin block creation. In essence, miners inject electrons into the network (via PoW) for security, and by extension electrify (and distribute) an entire process of value transaction and storage. For those of us deep in the monetary rabbit hole, this alone is a Good Thing. But Bitcoin's consumption-by-design also offers advantages to an energy industry grappling with a decarbonising, electron-based economy. To truly appreciate, consider the image below. What do we see?

Note two distinct elements; power plants (generation) and power grids (transmission and distribution). In the fossil fuel era, we generated a steady electrical output to meet a relatively static demand profile. The grid was in balance and supply hummed along nicely. In peak periods (like World Cup semi-finals and tense Eastenders moments), extra capacity was available via peak power plants or by temporarily shutting down industrial activities (such as steel production arc furnaces). But as we decarbonise, we retire reliable base load generation (think coal, oil, gas and even nuclear) and increase intermittency (via solar and wind power). And as we energise everything (from information to car engines, and now even money) our electrical infrastructure becomes the front line between civilised order and primitive chaos.

From Dirty, to Desired

So how do we maintain stability (at all levels) in the renewable energy era? What can we use to mitigate against a swing between excess supply and blackouts? Shaun uses the Texas electrical grid (ERCOT) to demonstrate the road ahead. The infrastructure here is isolated from the rest of the United States (i.e. there are no interconnectors), and does not have the benefit of hydroelectric generation (a natural battery system). Instead it must rely upon homegrown (and now decarbonising) power generation and utilise battery technology. And like our earlier example, facilities can shut down to free up capacity. There is a fancy name for this last approach; demand response. And it is the perfect fit for our humble little miner.

Digest this narrative shift; Bitcoin mining is far from a dirty trade secret. Instead, proof-of-work absorbs the grid volatility that comes with decarbonised power generation. In periods of excess solar or wind output (where renewable generation is greater than demand), miners can enter the market to soak up cheap, and otherwise wasted, energy. When demand picks up (during the working day and evenings), miners can efficiently power down without wasting effort (thanks to SHA-256 encryption). It contrasts starkly with existing demand response methods, that are disruptive and of limited use; arc furnaces can only come offline for 2 hours before steel starts to harden, for example (hat tip Mr. Connell). With Bitcoin mining, we introduce a quantum leap in demand flexibility.

Proof-of-Utility

From a technical perspective, this makes perfect sense. But what of the economics? In (super) basic terms, power generation companies now have another eager customer for their output (alongside the grid and thirsty industrial processes). They could still employ PoW to consume excess generation even if Bitcoin was valued at $0. As for miners, they can use a hedging strategy to counter energy price fluctuations; when they are in operation, they earn in Bitcoin. And in shut down periods (due to high demand and pricing), they can be compensated by a contract for difference. It is an example of real-world utility that the wider cryptosphere (and hence proof-of-stake) can only dream of. It also begs the question; when will energy companies commence mining activities?

But there's more! Climb back into the monetary rabbit hole and you realise that renewable generation no longer requires grid connectivity to monetize their output. Bitcoin can become a buyer-of-last-resort, meaning that previously stranded solar and wind resource could co-locate with miners for economic viability (in remote regions like the Australian outback). The additional incentive could turbo-charge growth in the renewables sector; promoting both manufacturing and cost efficiencies. So on reflection, I think our innocent polar bears can sleep a little easier. To bring the point home, listen to what the top brass at ERCOT have to say (forgiving the 'crypto' faux pas):

BTC is ESG

Now let's return to our favourite corporate acronym, ESG. And digest yet another, more delicious narrative shift; there is an alignment with BTC that is truly (or perhaps wilfully) under appreciated. Bitcoin is an exceptional example of distributed governance. The network can alleviate our current social ills by fostering financial solvency and a can-do, entrepreneurial spirit. And mining has environmental qualities that can no longer be denied. It's bloody remarkable, this magic internet money.

Here's another, wider point. Sustainability (in the guise of ESG) is not a narrow argument for curtailing energy use, or a malicious excuse for top-down command and control. Instead, sustainability is a state of being; an electrical density which helps us to survive in adverse climatic conditions (think desalination, air conditioning and cathodic protection). The drive to decarbonise just reflects our desire for abundant energy, and thus our intuitive attraction to renewable generation. The clue is in the name, folks.

Consider these wise words from Saint Connell of Texas; photovoltaic cells and wind turbines allow us to 'manufacture' energy, almost anywhere. Bitcoin now removes the technological and economic limitations on their output, thanks to a wonderful quid pro quo. By absorbing grid volatility and monetizing stranded renewables, Bitcoin promotes abundant energy (and thus sustainability). And by scaling mining activity (hashrate), abundant energy secures the network and its value to society (as a formidable source of truth).

Taken together, this bears a remarkable resemblance to Henry Ford's Energy Currency; an alternative to the Gold Standard proposed over 100 years ago. Perhaps this time around a distributed electro-money, enabled by renewable energy, can hit the big time.

Topics

Disclaimer; the views and opinions expressed in this posts are those of the post’s author and do not necessarily reflect the views of Long Curiosity, or its affiliates. This post has been provided solely for informational purposes and do not constitute an offer or solicitation of an offer or any advice or recommendation to purchase any securities or other financial instruments and may not be construed as such. The author makes no representations as to the accuracy or completeness of any information in our posts or found by following any link in this post.

.png)